Table of Links

2. Financial Market Model and Worst-Case Optimization Problem

3. Solution to the Post-Crash Problem

4. Solution to the Pre-Crash Problem

5. A BSDE Characterization of Indifferences Strategies

Acknowledgments and References

Appendix A. Proofs from Section 3

Appendix B. Proofs of BASDE Results from Section 5

Appendix C. Proofs of (CIR) Results from Section 6

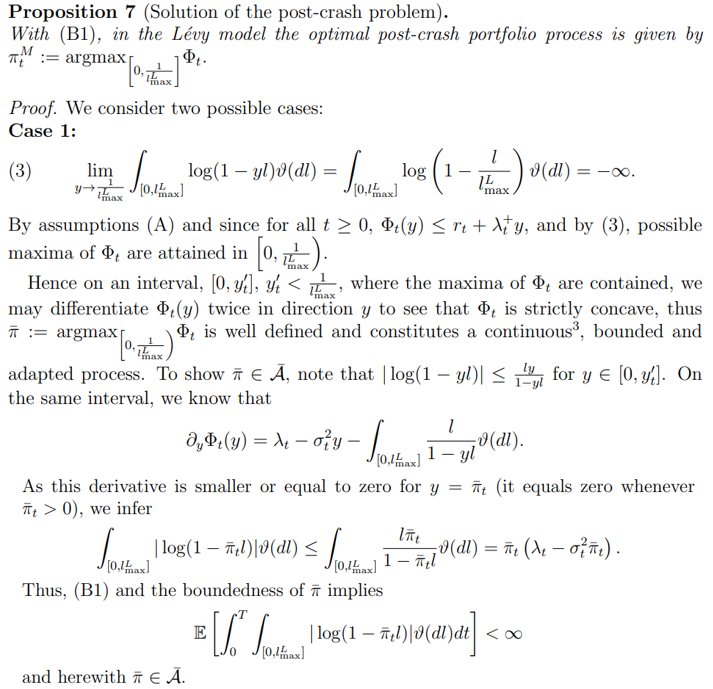

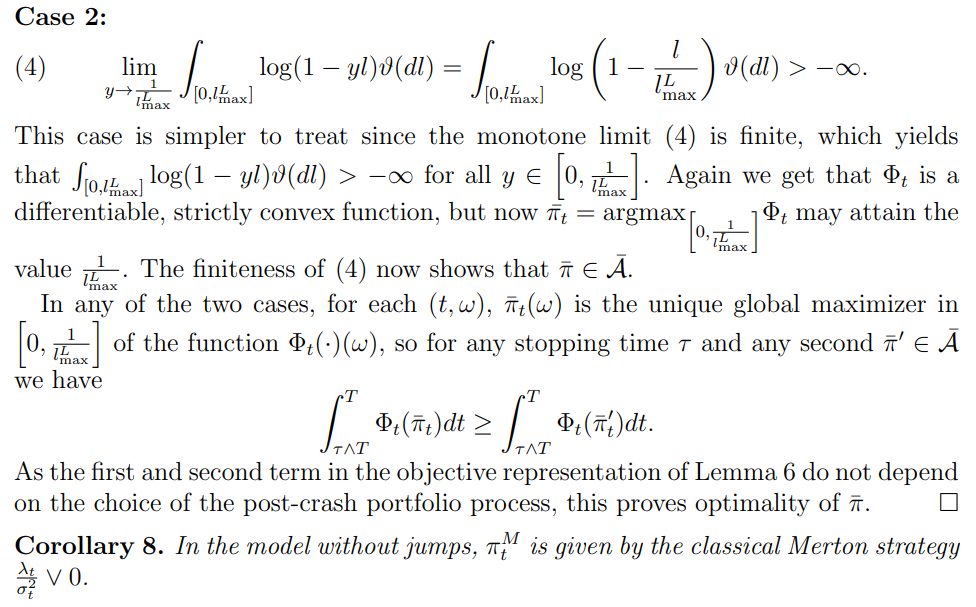

3. Solution to the Post-Crash Problem

As is common in the worst-case optimal investment literature, the above problem can be solved by first considering for each crash scenario τ the post-crash problem starting at time τ , which is a classical portfolio optimization problem, compare e.g. Korn and Wilmott [39], Seifried [49]. Using the explicit representation of the objective from Lemma 6, the following result is immediate her

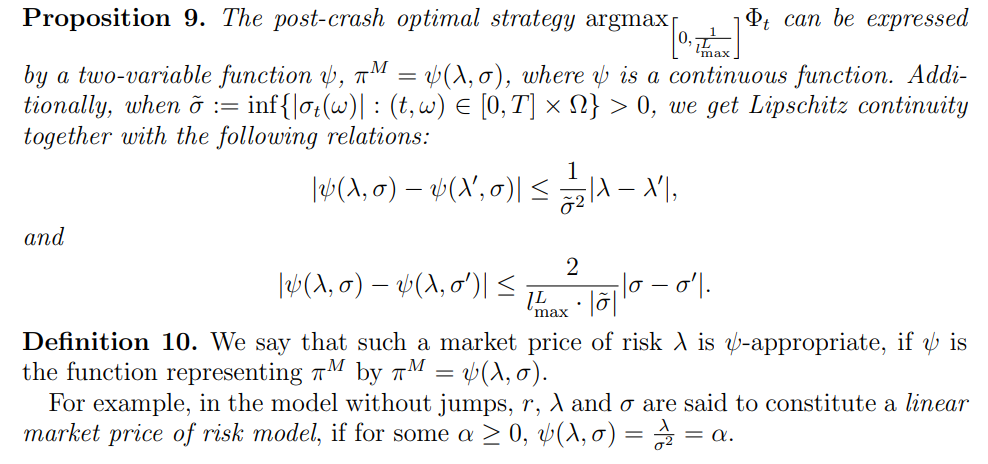

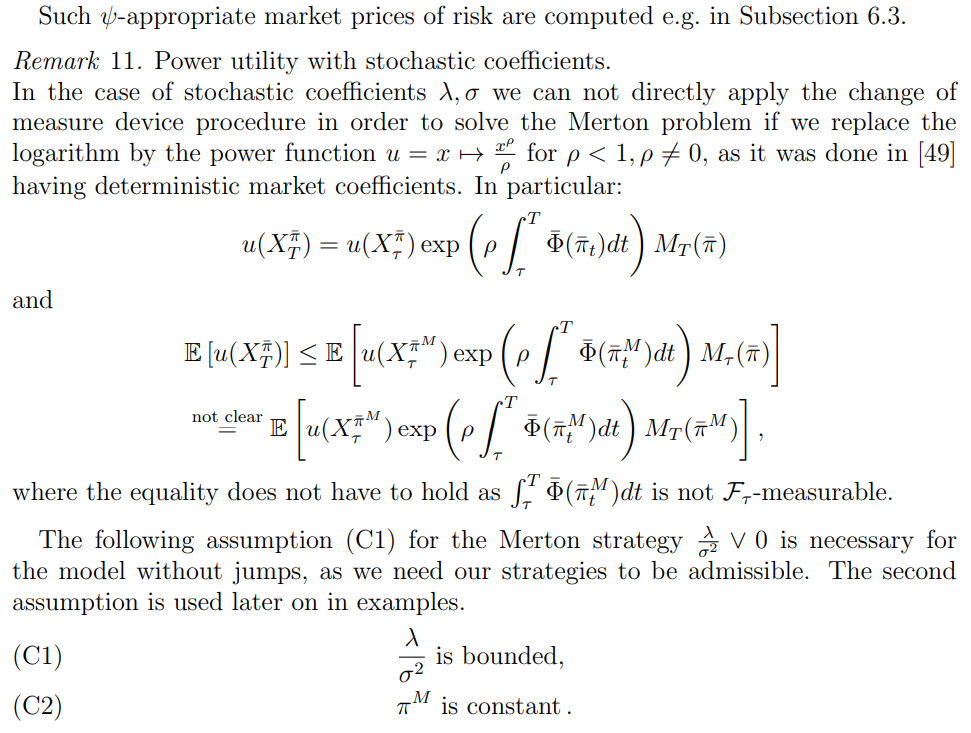

We moreover need the following useful property of the post-crash optimal strategy later when proving optimality results; the proof can be found in Appendix A.

Authors:

(1) Sascha Desmettre;

(2) Sebastian Merkel;

(3) Annalena Mickel;

(4) Alexander Steinicke.

This paper is available on arxiv under CC BY 4.0 DEED license.

[3] See Stokey et.al., Recursive Methods in Economic Dynamics, Thm. 3