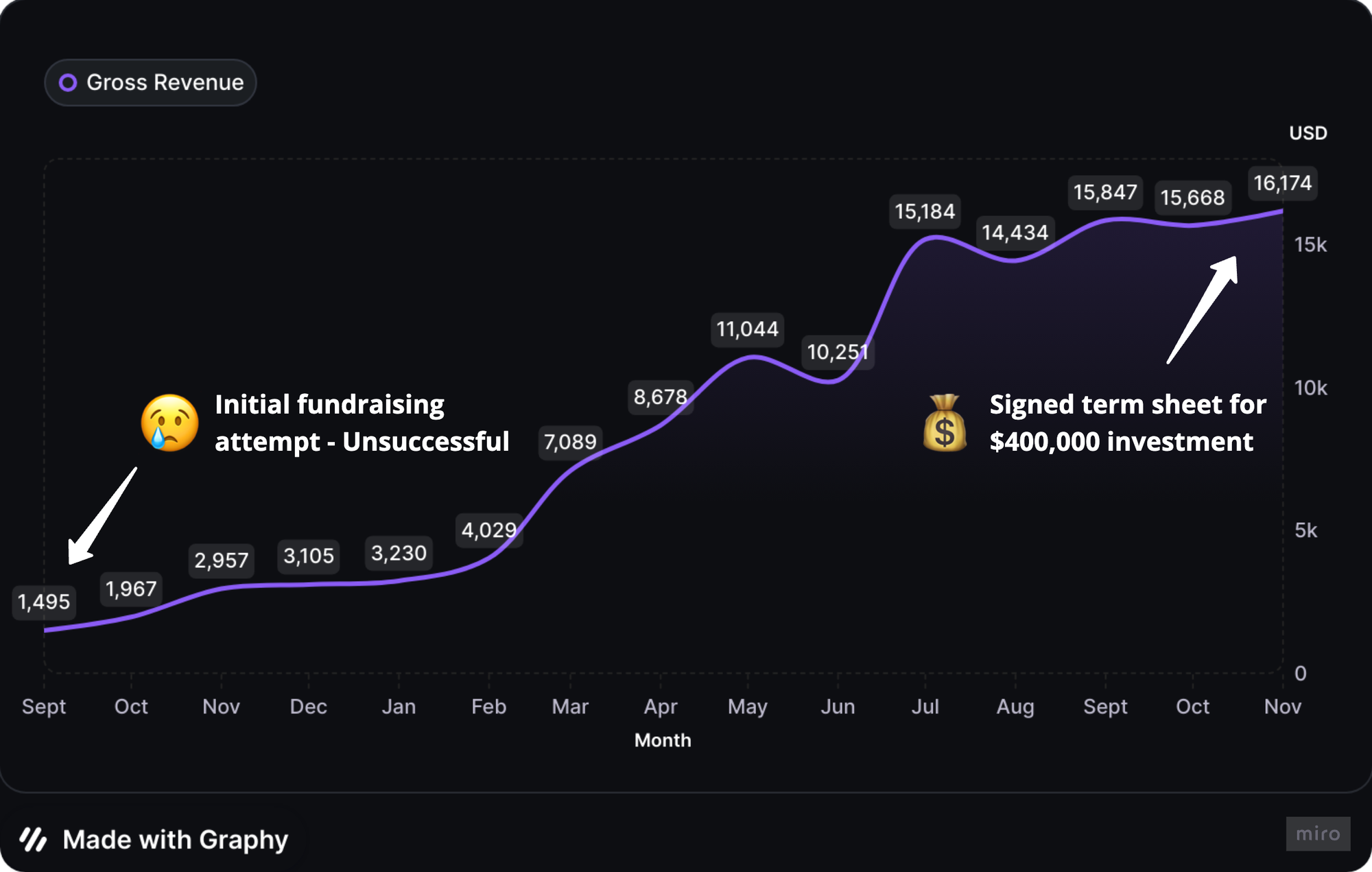

Building a two-sided managed pet care platform as first-time founders is not an easy task. Looking back, it's clear that some intuitive decisions brought us to where we are today. After 1.5 years of bootstrapping, we raised $400,000 from a VC fund and an angel syndicate, with follow-on investments totaling $1 million. We now have 30,000 paying customers, 3,000 pet caregivers connected to our platform, and over $5 million in gross revenue since launch.

Here's my reflection on the key decisions that brought us to this point.

Tip 1: Don't Chase Investors Too Early; Focus on Traction First.

A couple of months after our launch, with our first customers on board, we thought raising funds would be a breeze. We prepared a conventional pitch deck and business model and started meeting with angel investors and early-stage VCs. However, we quickly realized it was challenging to convince investors to back two first-time founders with a business earning only $1,500 monthly.

With our personal runway nearly exhausted, we had an honest discussion and asked ourselves: Do we want to continue without securing a seed round? The answer was yes. We then asked ourselves how we could survive and improve our chances of fundraising later. We decided to stop wasting time chasing investors and focus on gaining traction.

This decision boosted our team's morale. Our success was now in our hands, not dependent on funding. By focusing on traction, we implemented key changes that helped us grow tenfold in one year. I'll discuss these changes in the following tips.

Tip 2: Improve Your Unit Economics – Be as Effective as You Can to Survive.

One of the challenges we faced in becoming profitable was our low take rate. We launched with favorable terms for pet caregivers: after subsidizing transport expenses, our take rate was 18%. This motivated pet caregivers to serve our first customers, but it wasn't enough to achieve profitability quickly with a bootstrapped approach.

I wondered: What if we could earn more from every order? What if we could acquire new pet caregivers on more favorable terms for the company? What if existing pet caregivers accepted changes in the transport subsidy? Changing the amount our service providers earned was daunting, but two adjustments helped us double our take rate to 35%:

- Introduce a cap on transportation coverage.

- Increase our take rate for new pet caregivers joining the platform.

Sometimes, we underestimate the value our business provides to users. It's crucial to constantly ask: What if we could earn more on each unit?

Tip 3: Try Bootstrap Marketing Instead of Paid Ads.

As a startup with a novel concept, you'll likely struggle to win user trust initially. Limited funds for ad testing and the need for quick results often lead to lower conversion rates compared to established competitors. This makes it challenging to achieve positive unit economics from paid channels early on.

Our first attempt at SEM didn't yield results, so we explored alternative channels due to budget constraints.

Here's what worked for us:

📣 Send Press Releases to the Media Outlets

First, we sent press releases to major lifestyle media in our region. Some picked up the story and announced our product launch. Consider researching media outlets relevant to your field and reach out to them. Establishing a public presence for your brand is crucial in the early stages.

🤴 Partner with Industry Experts

Next, we partnered with respected influencers in our field. When they mentioned our business to their audience, we gained both warm leads and valuable social proof. These leads were already confident in our product due to the influencers' endorsement. Who are the key voices in your industry? Is there potential to build connections with them?

👩💼 Tap into Corporate Networks

Our third effective channel was partnerships with enterprises. They promoted our exclusive offers to their employees through internal communications, helping us secure early adopters from their workforce. If your product or service has broad appeal, consider exploring ways to include it in corporate benefits programs.

Tip 4: Consider Additional Revenue Streams, Even if They Seem to Diverge From Your Initial Focus.

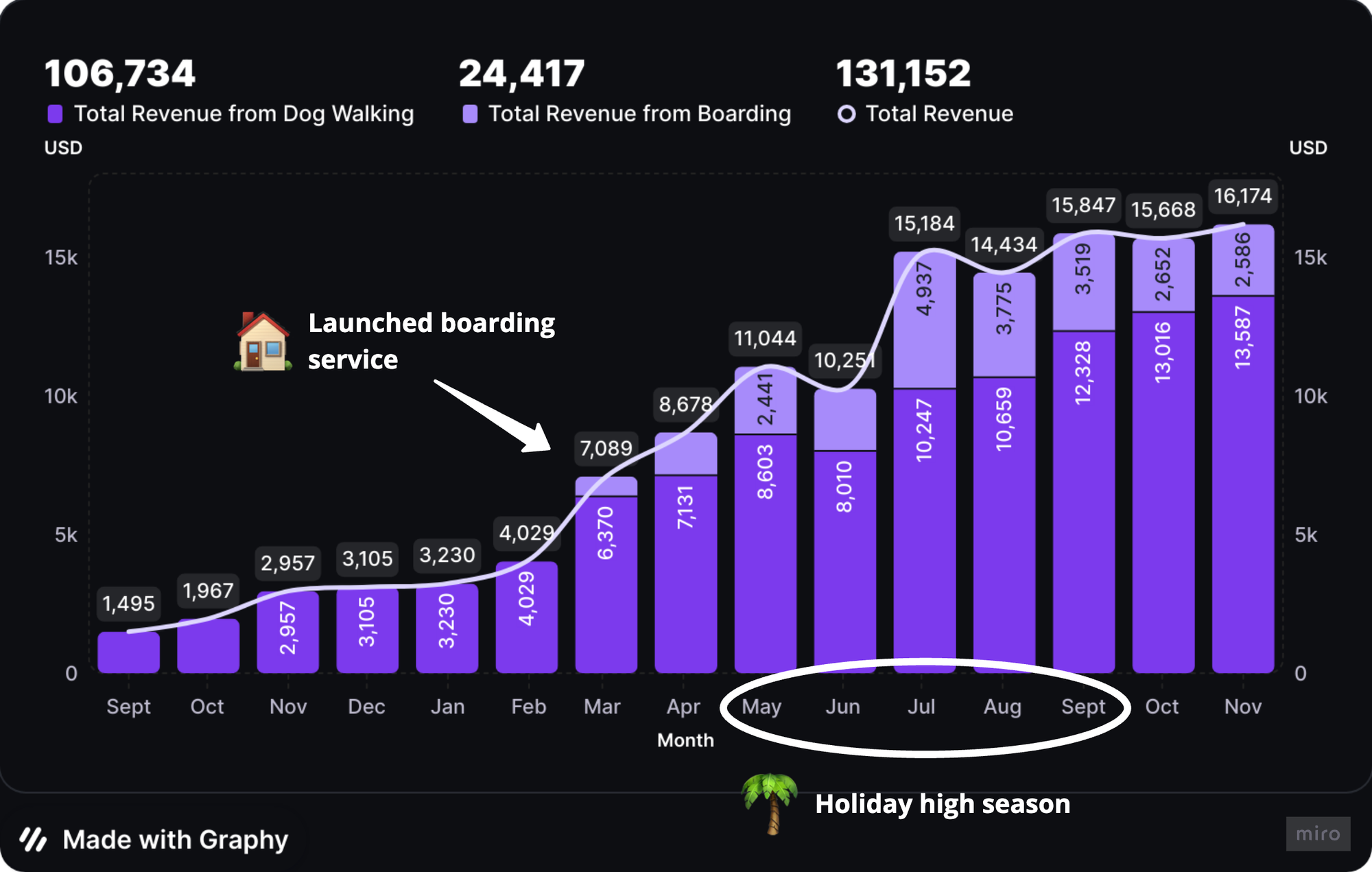

When we launched our pet care platform, we initially only connected pet parents with dog walkers. However, we soon realized that adding dog boarding could provide an additional revenue stream because:

- Our existing customers were requesting boarding/sitting services.

- International competitors already offered this product vertical.

While launching a new product might seem risky or unfocused, it's crucial to differentiate between introducing a completely new offering to a new audience versus a complementary product for your existing customer base. In our case, we were fortunate to launch the dog boarding vertical just before the vacation season when people frequently cancel walking services and search for dog sitters.

This decision significantly influenced our successful investment round closure. The boarding vertical generated an additional $24,400 in revenue, which, when annualized, added approximately $280,000 to our pre-money valuation during deal discussions in October (having multiple ~9X to yearly gross revenue).

Tip 5: Find an Advisor From a Similar Company That's a Few Steps ahead of Yours.

After our launch, we were fortunate to bring on board a mentor/advisor who was a co-founder and CEO of a Round A stage company with a similar on-demand business model - a medical tech company providing house call doctor services. Orders are placed via mobile app and chatbot as we do.

His guidance was crucial in several key areas:

💰 Fundraising

Our advisor tipped us off about a startup competition organized by McKinsey & Company. Among the organizers and jury members were angel investors who had backed his medical company. I believe having him as an advisor significantly boosted our chances during the initial selection stage, where only 12 companies were chosen out of 600+ applicants.

The organizers were already familiar with him and understood the on-demand business model, putting us in the right place at the right time.

We made it to the finals and, although we didn't clinch the win, we still managed to secure a seed round from an angel syndicate that included jury members from the competition.

Consider bringing on board someone with hands-on entrepreneurship experience in a similar market or with a comparable business model. They can provide warm introductions to investors, which can be invaluable.

🎓 Re-use best practices

As a first-time founder, especially a young one like myself, you often lack experience in areas like people management, stakeholder relations, and hiring. Sometimes, you might need specific advice on topics like launching paid ads without failing.

Having someone who's already gained this experience can significantly reduce mistakes, saving company funds and ultimately increasing your chances of success. The key is to listen and learn.

🆘 Moral Support and Constant Challenging

Being an early-stage venture founder means constantly managing your emotions. You might swing from "we're the worst company ever, customers will stop using our app" when you receive a negative Trustpilot rating in the morning, to "we're doing quite well" when you deploy a new feature later that day.

Things become even more intense when you attract funds, bring investors on board, start hiring employees, and sometimes need to let go of underperformers - it's quite stressful.

Moreover, without a boss, it can be hard to adequately assess your own performance - is it poor or good? Having an advisor can help you handle stress as you can transparently discuss all ups and downs. But they can also provide the feedback you need to improve, which is harder to receive when you're working on your own project without someone senior above you.

Conclusion

I believe these five strategies were crucial to bootstrapping our growth and securing seed funding. Every startup's journey is unique, but focusing on traction, optimizing operational efficiency, and leveraging experienced mentors can significantly increase your chances of success. I hope my insights prove helpful to entrepreneurs building early-stage products.